PNC Private Bank

Timeline

2019 - 2021

My Role

Senior Product Designer

Time and Transfers

PNC Private Bank is a branch of aging high net-worth customers that have millions of invested assets. These clients are more concerned about how their money will assist their family in future. PNC wanted to prepare for a great movement of money to a younger generation and improve their digital products.

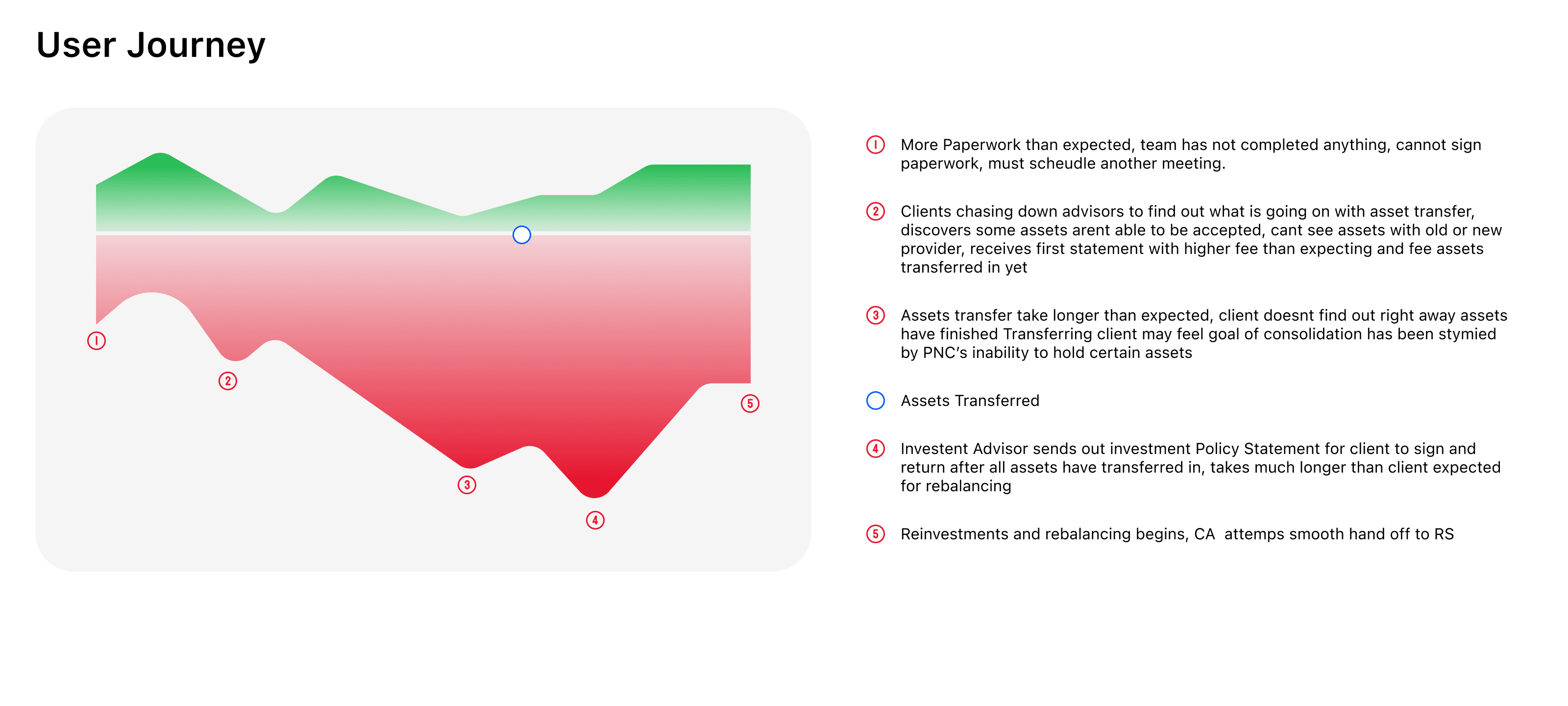

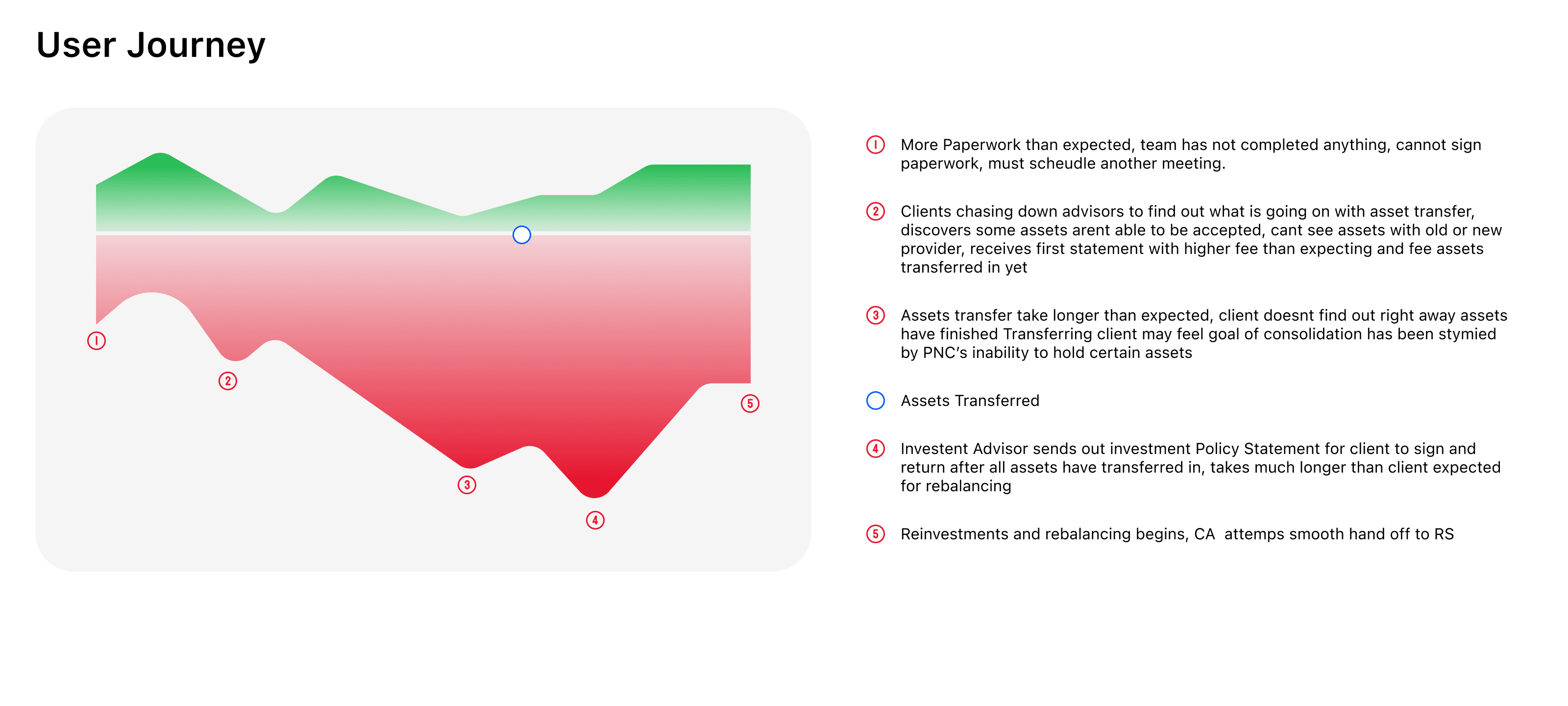

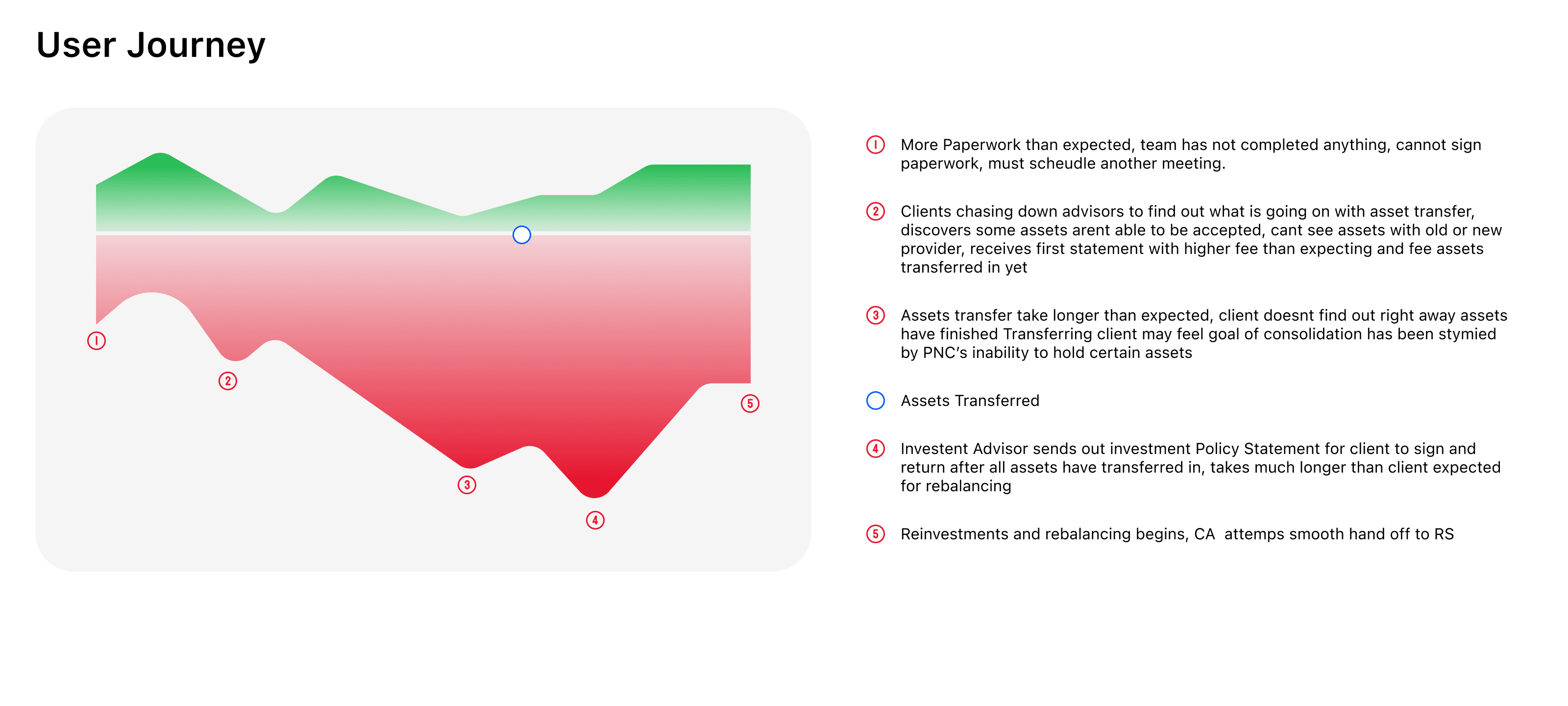

We started with the most obvious question. How do new and existing users move money? AND boy…. its rough.

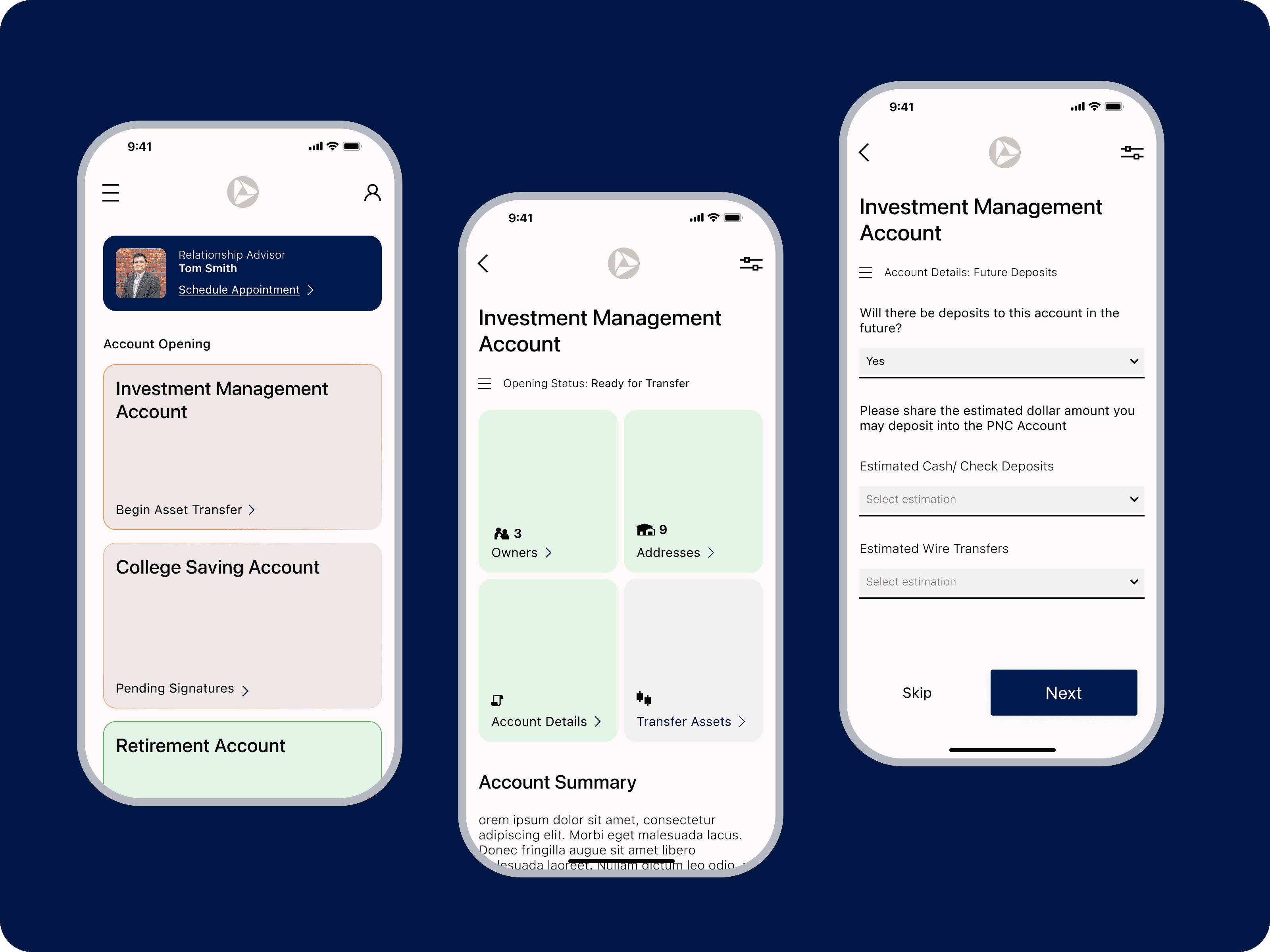

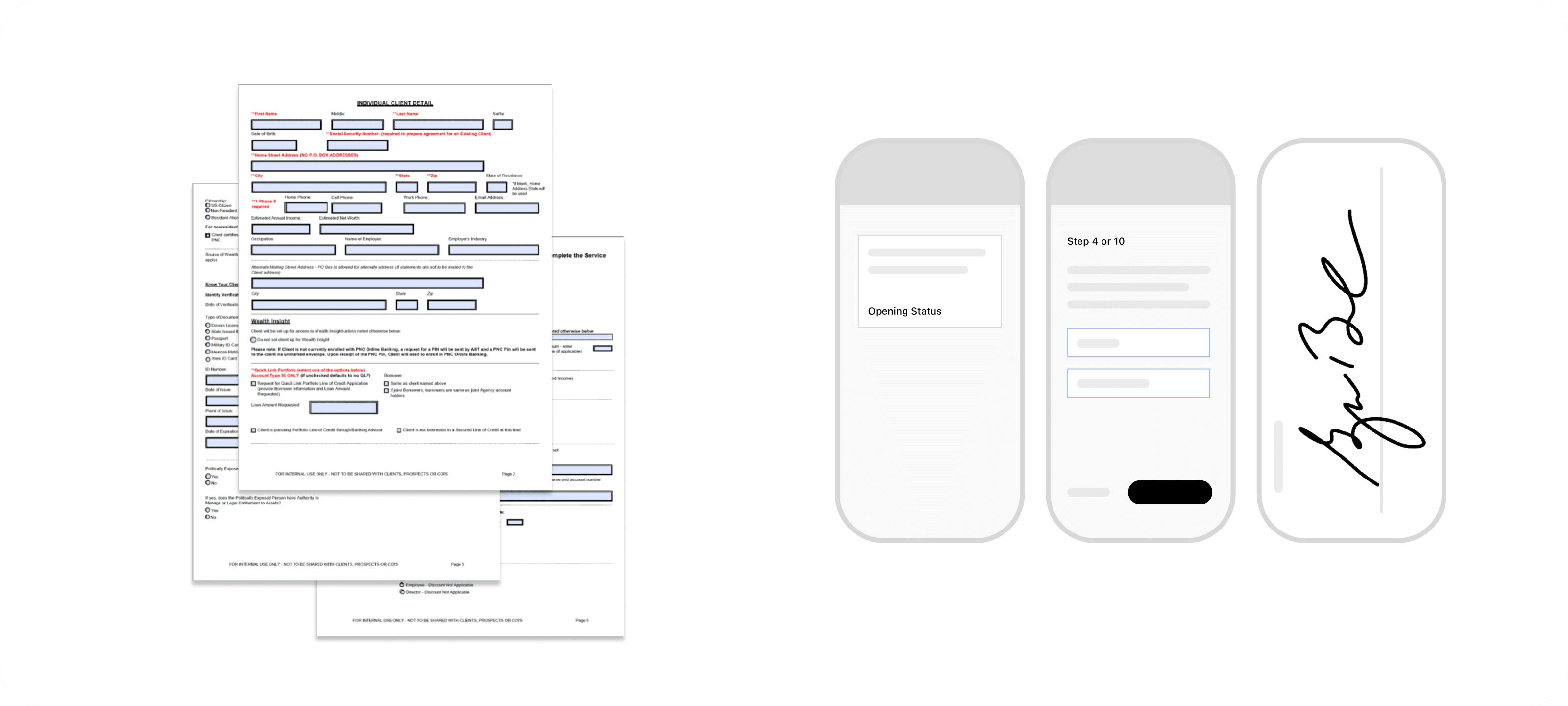

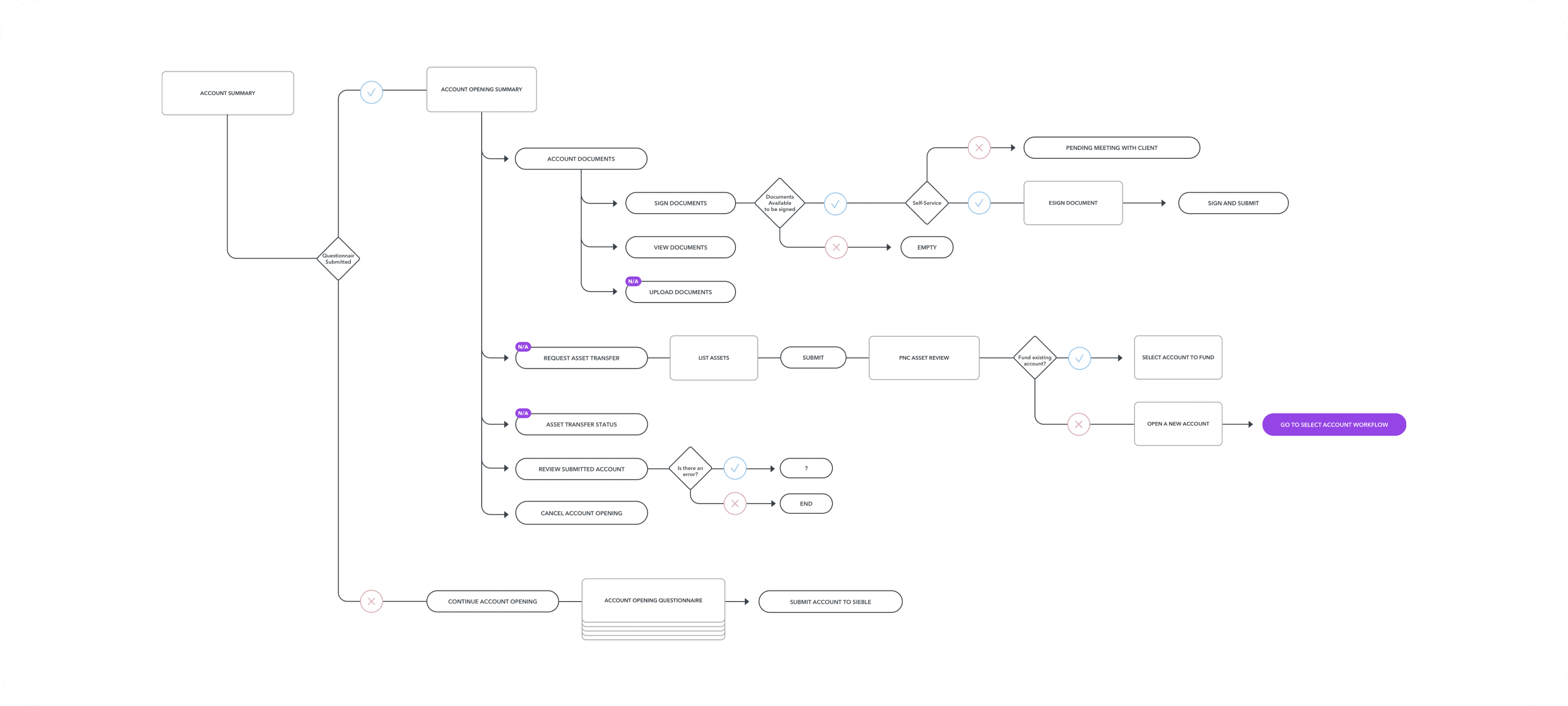

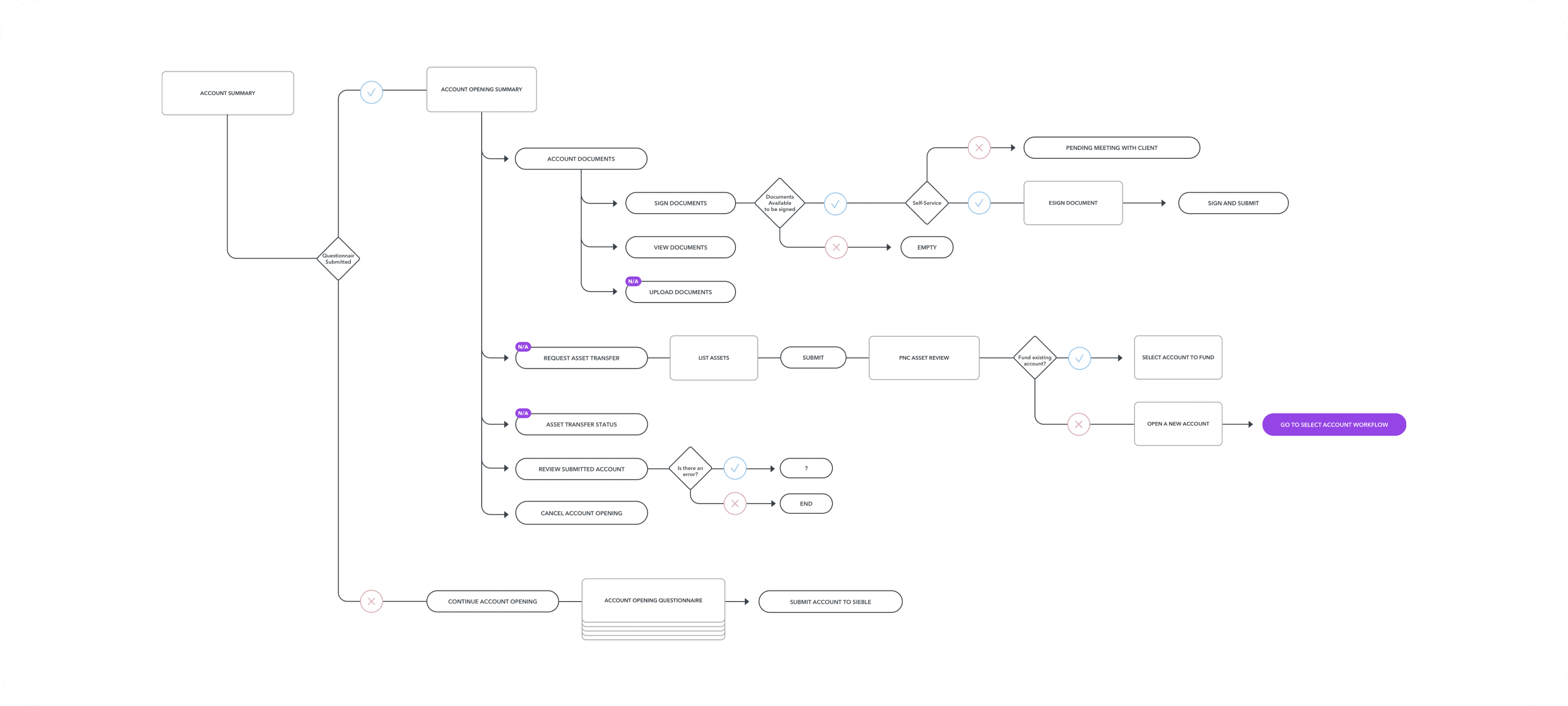

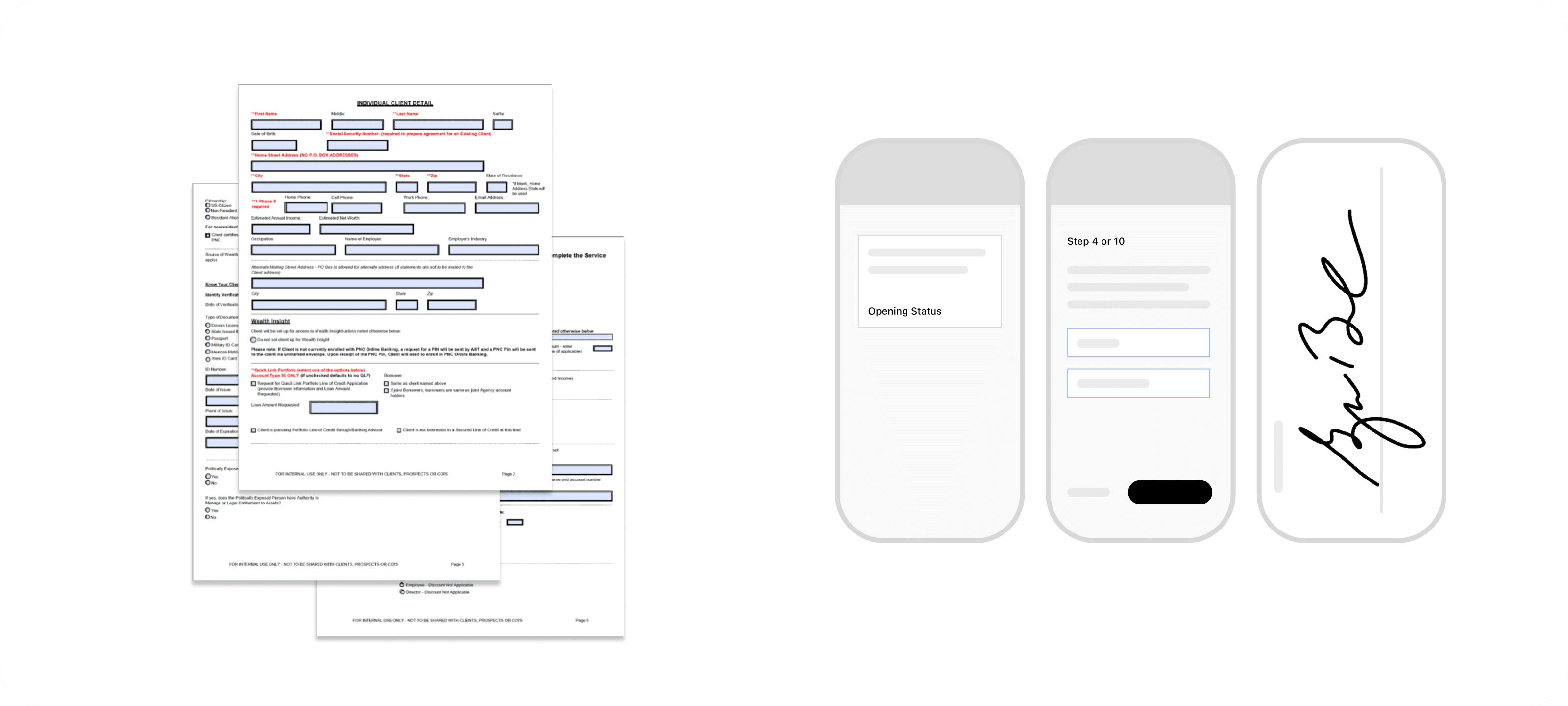

Print to Pixels

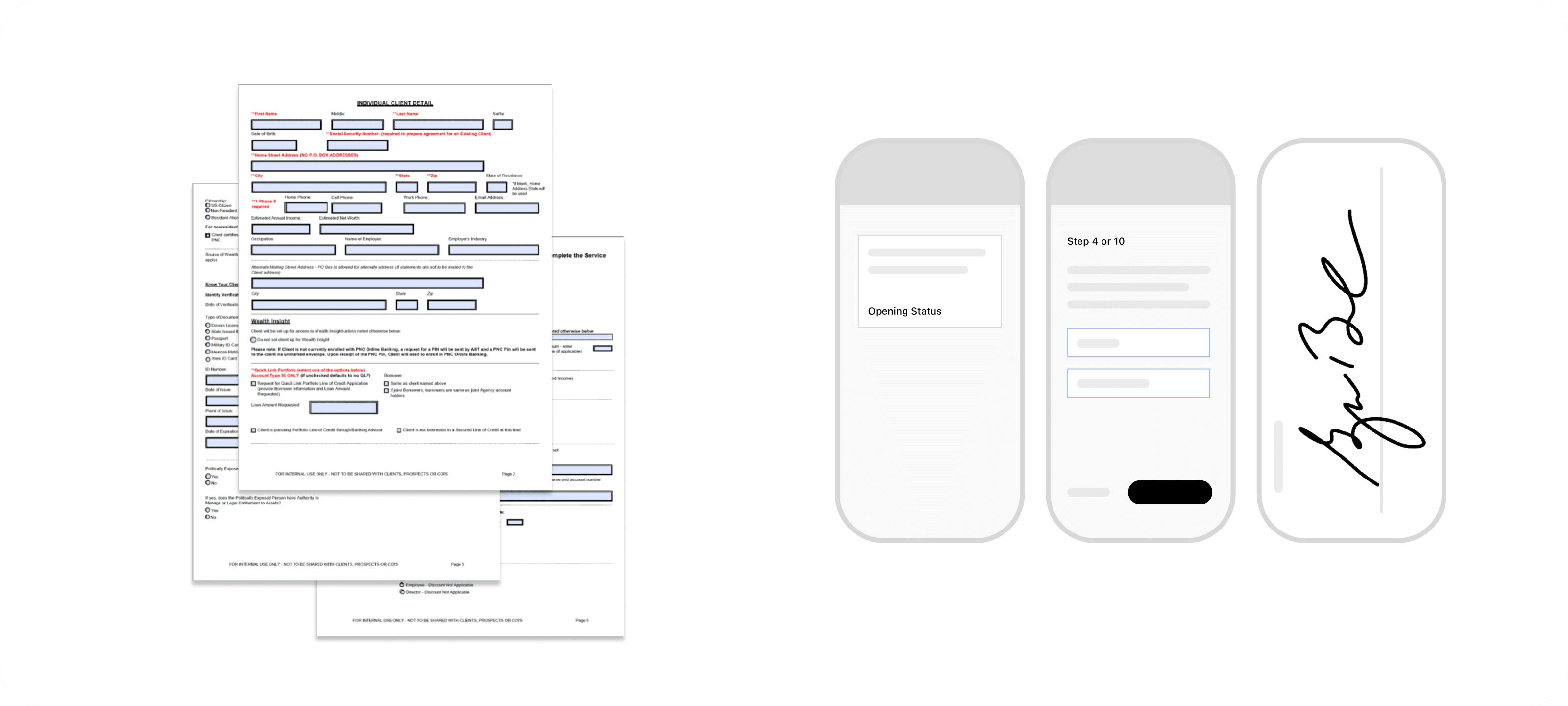

PNC hasn't touched their Assets Management Account opening process since the Blackberry was #1 . Everything has always been done on paper/in-person, taking months to transfer assets . We wanted to update the process to something users have direct access to and track statuses.

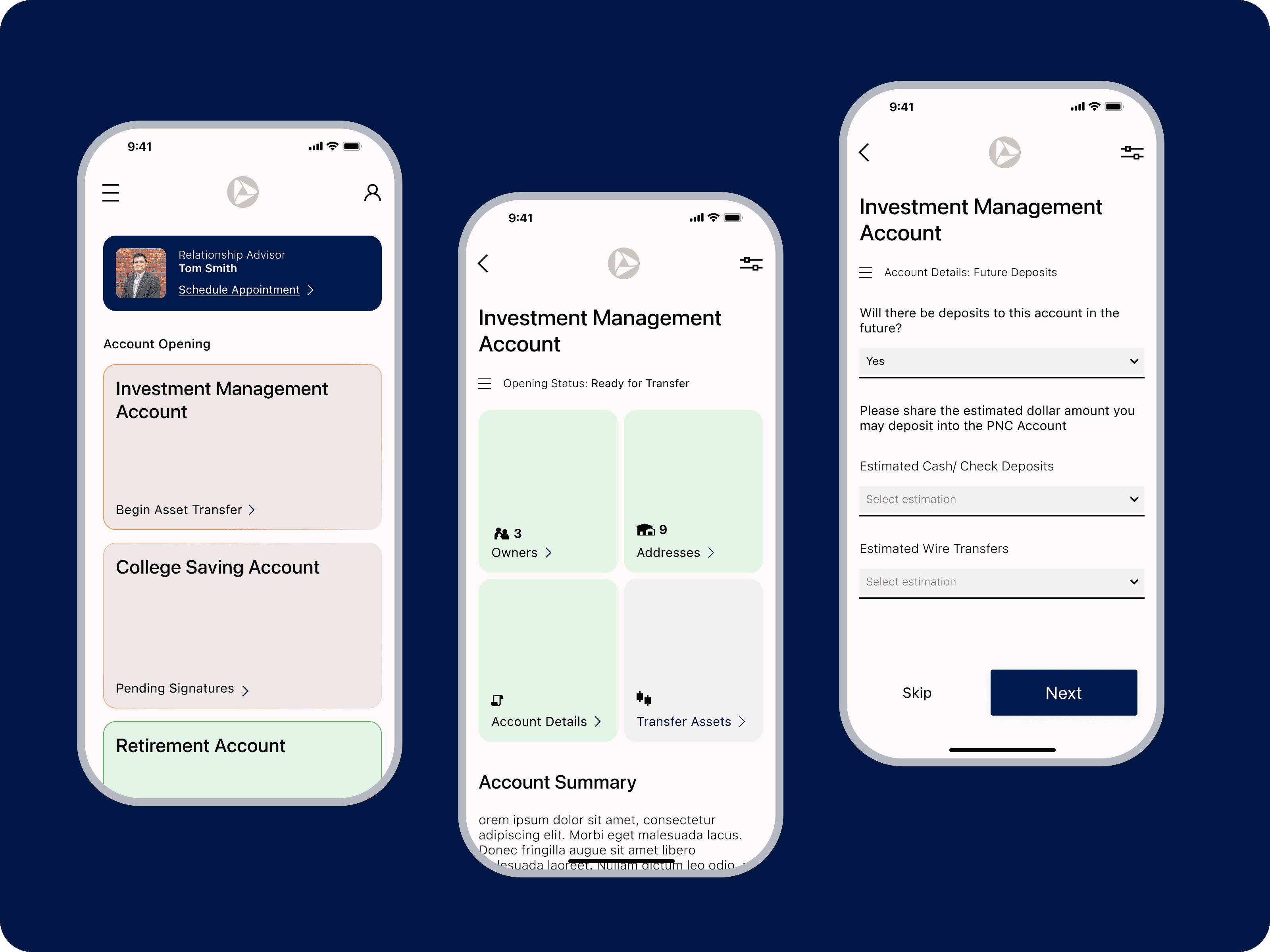

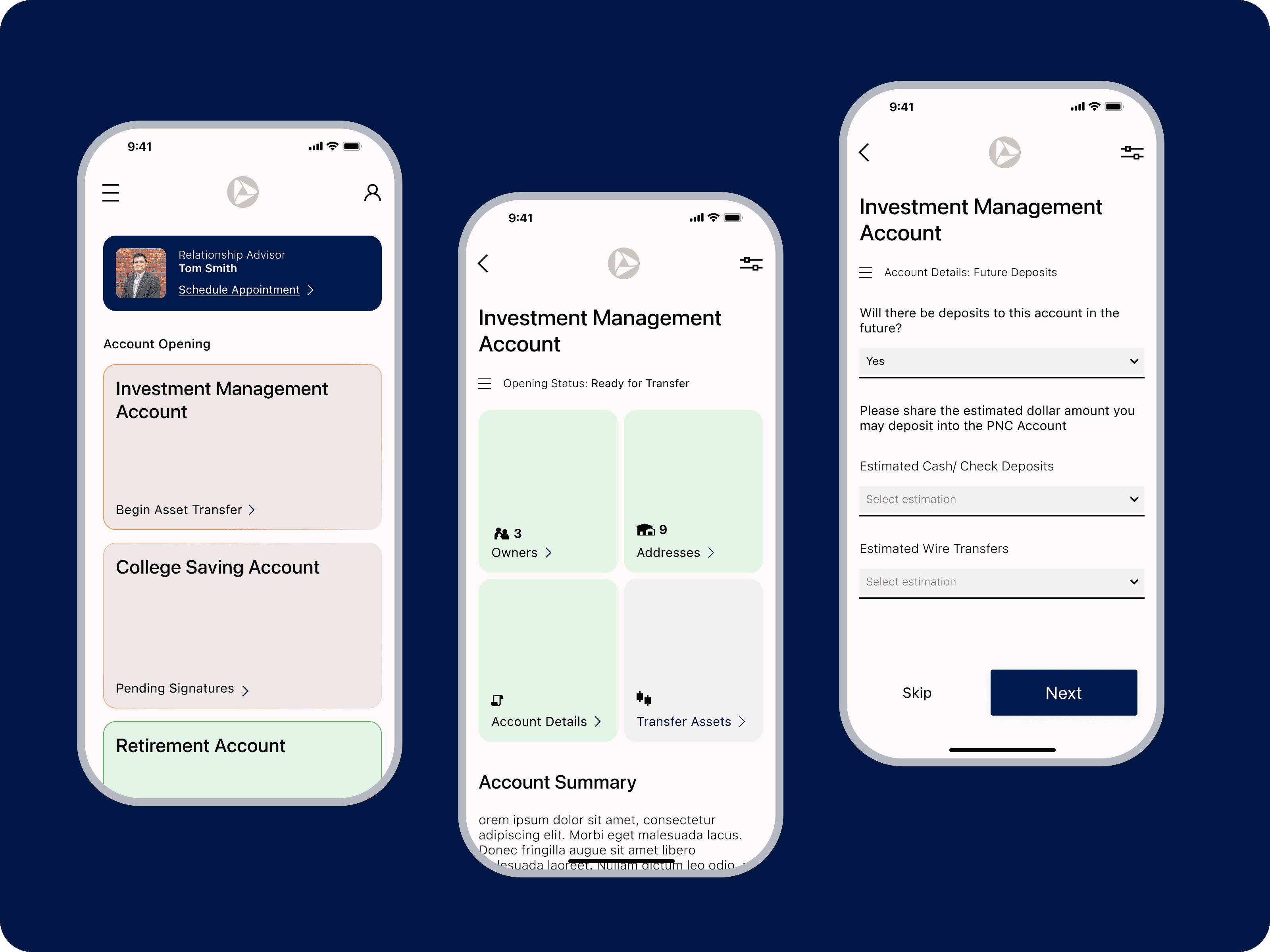

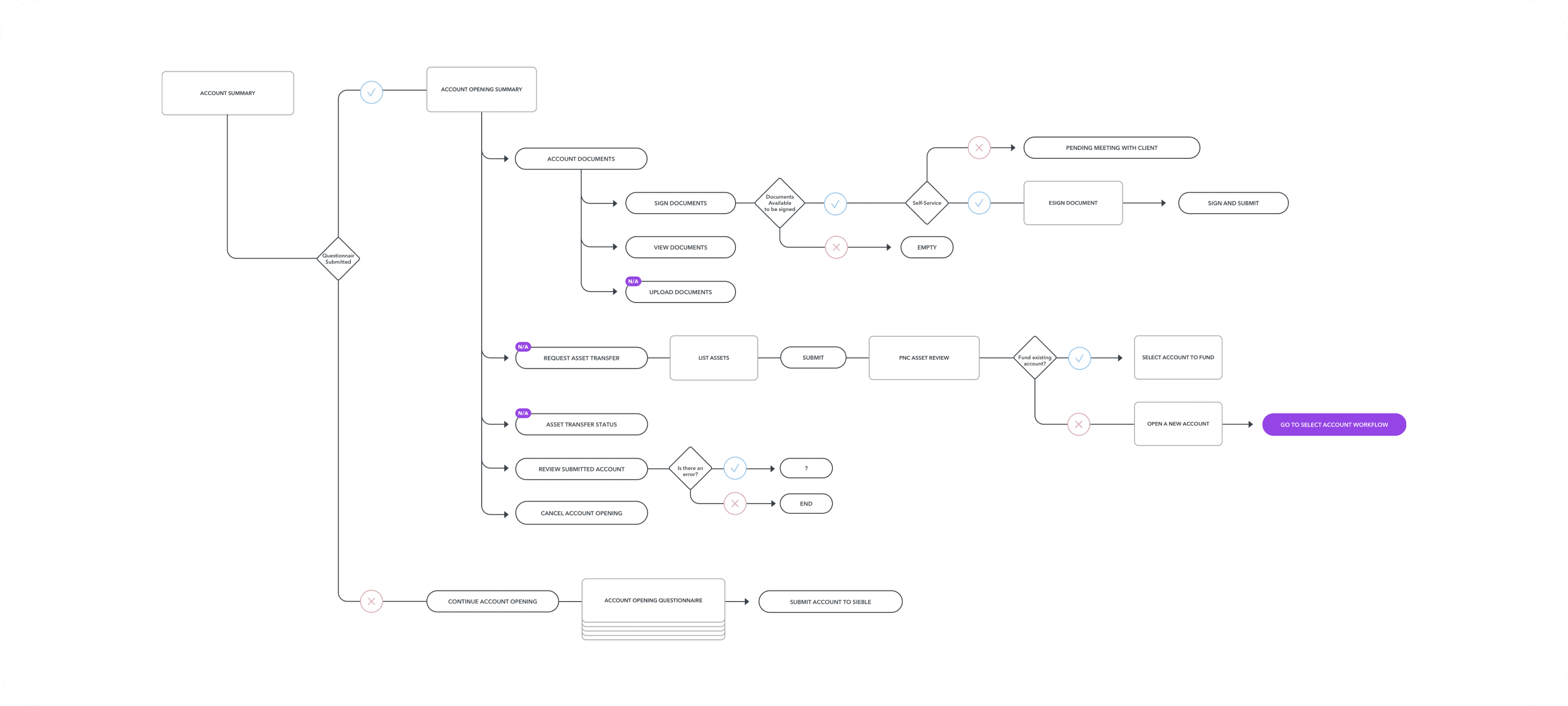

Make it smarter and not an Advisor secret

We created a process to make this process smarter rather than a subjective decision. Our new experience for setting up accounts would recommend account types based on users needs and portfolio sizes. Not only that, They could get the account started without having to meet up with an advisor at the local their Starbucks where someone has returned their latte twice and loudly complaining, all while you're trying to explain your families life goals to a stranger.

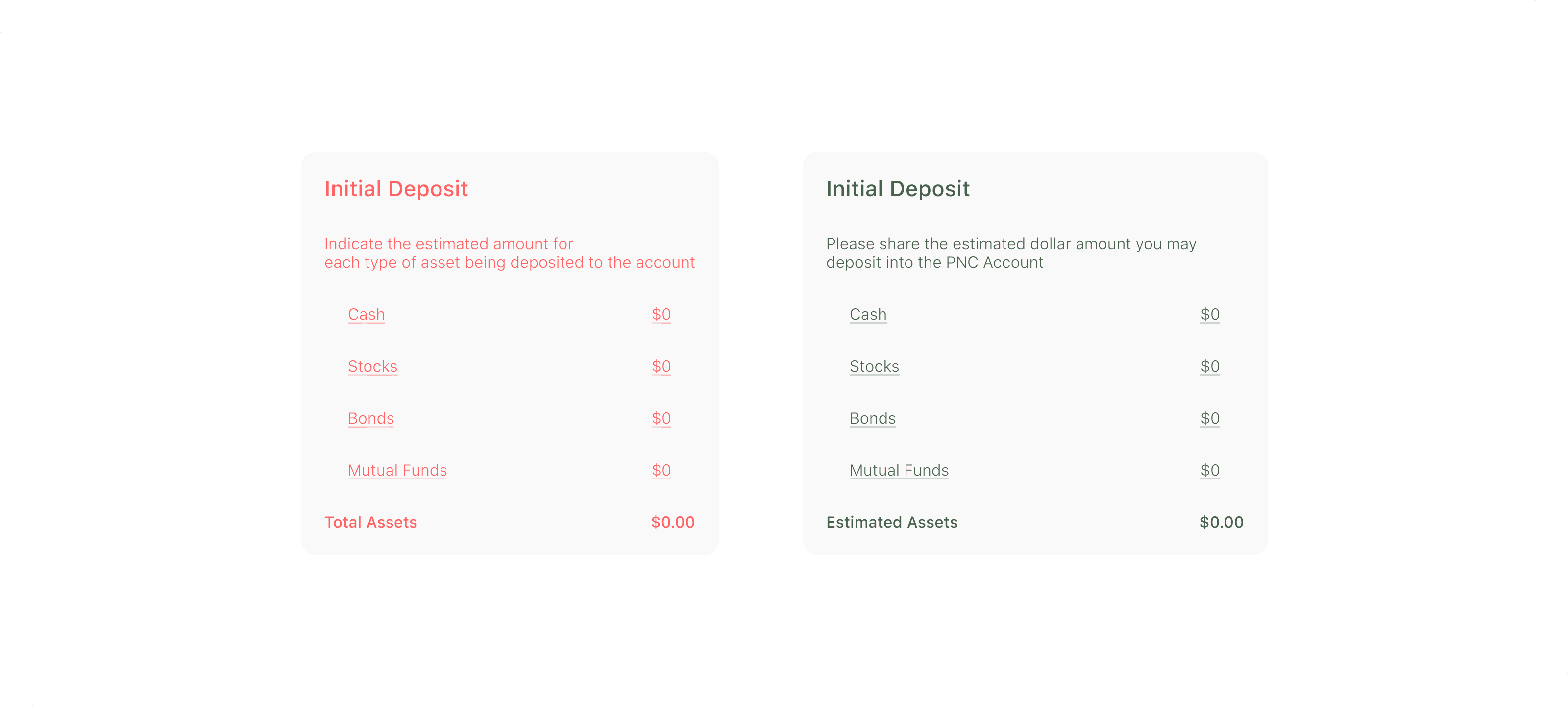

Making it sound less 'suit and tie'

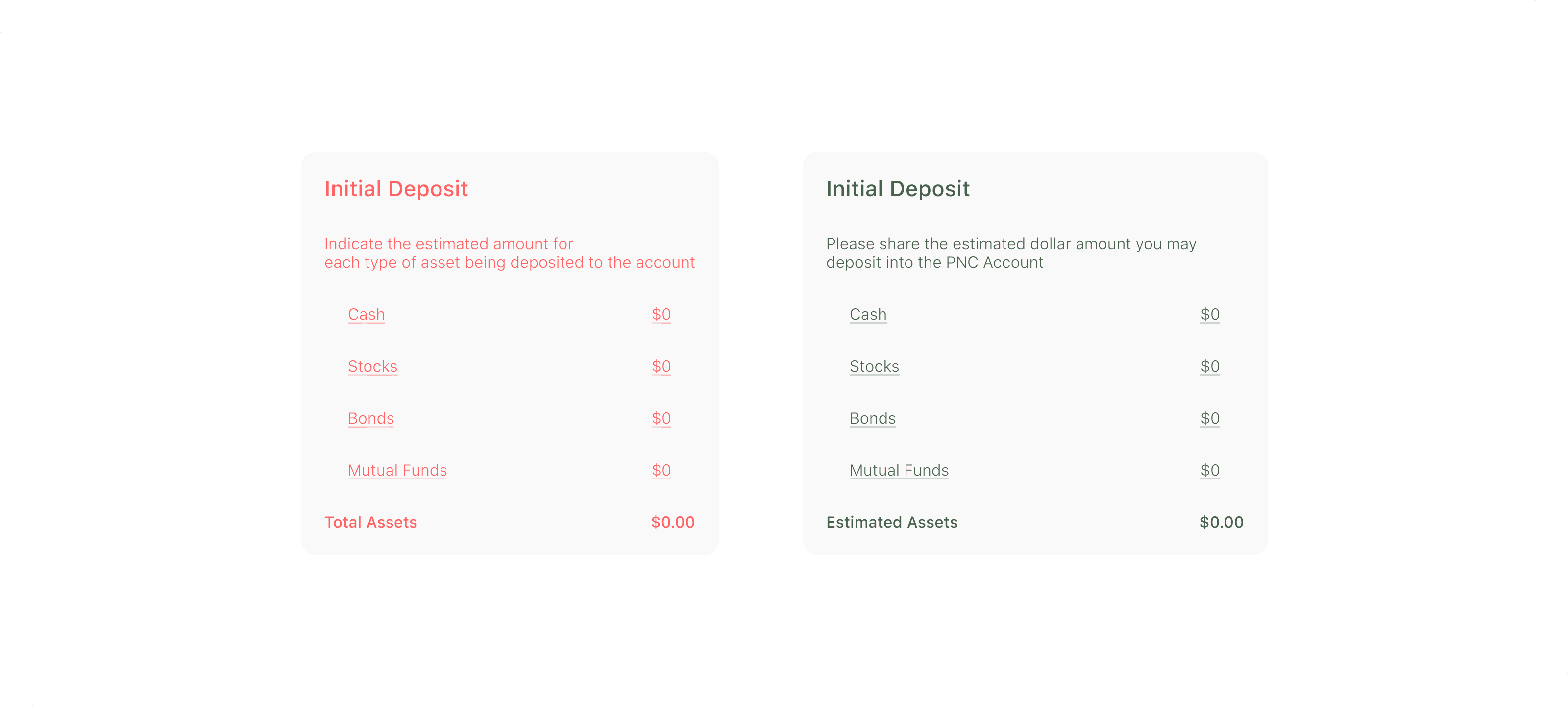

In taking an old process and making it crisp for new users, we had to change a lot of the conversations. We Modified the lingo to either educate or better explaining how answer will effect their account.

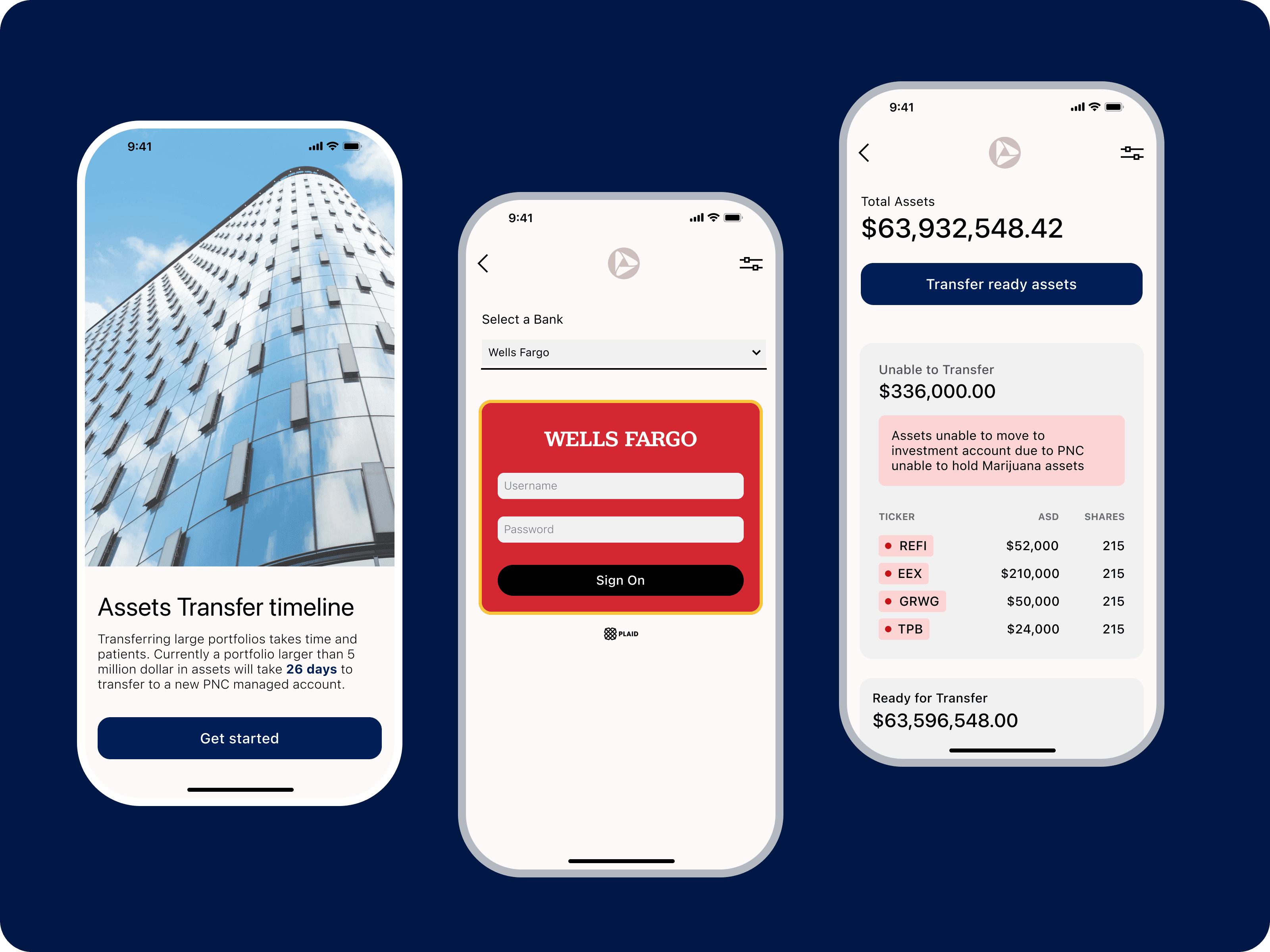

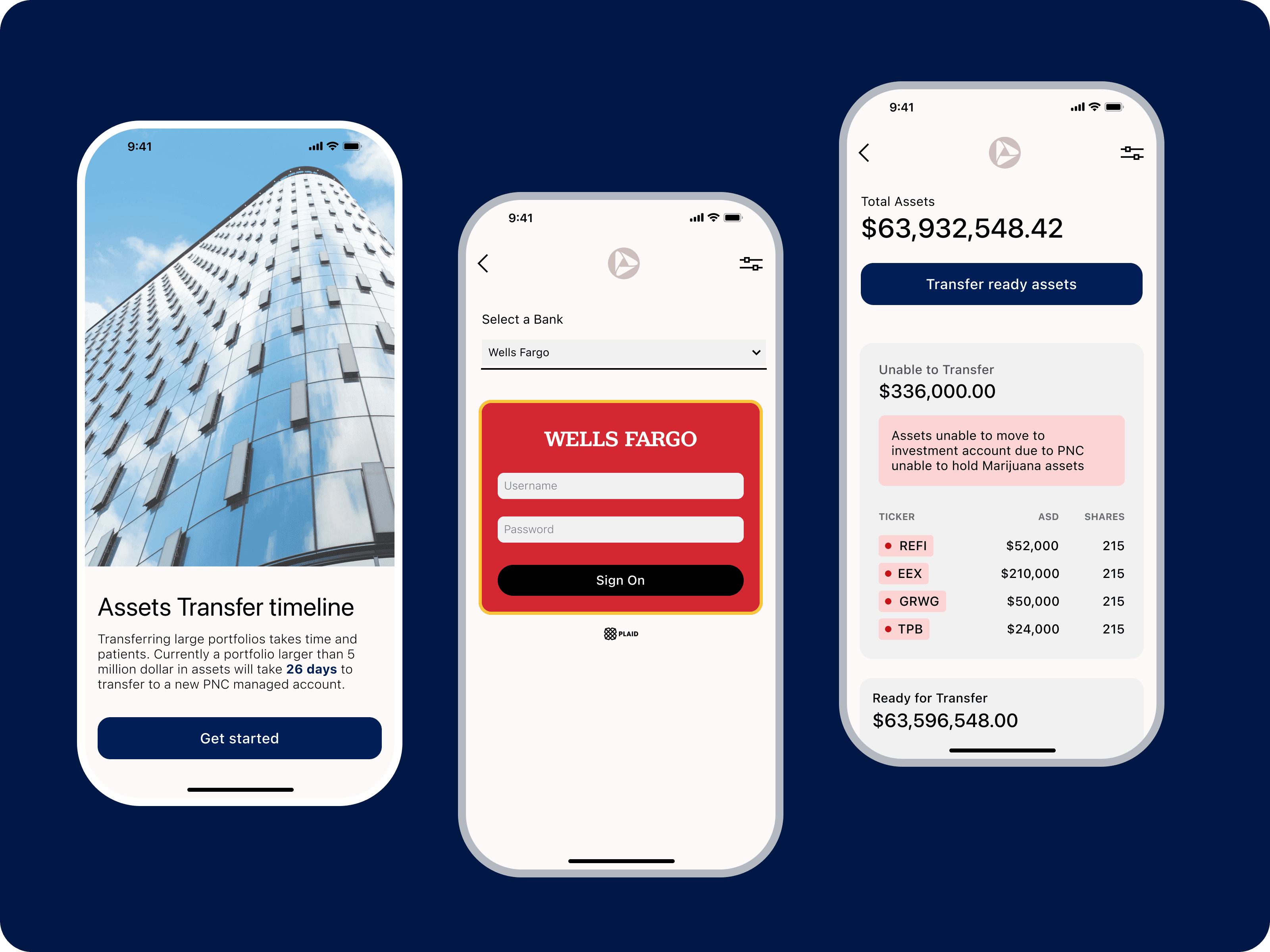

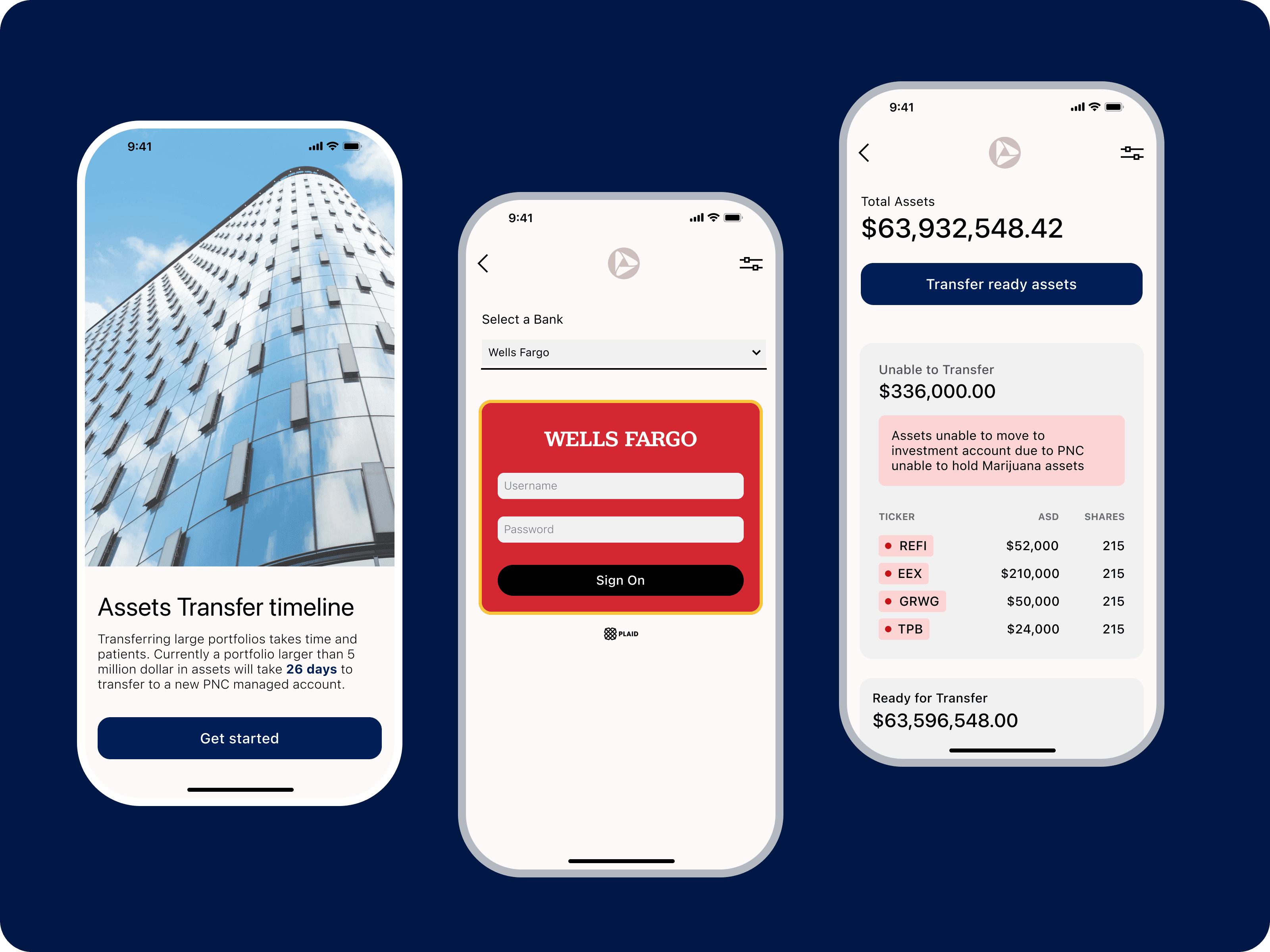

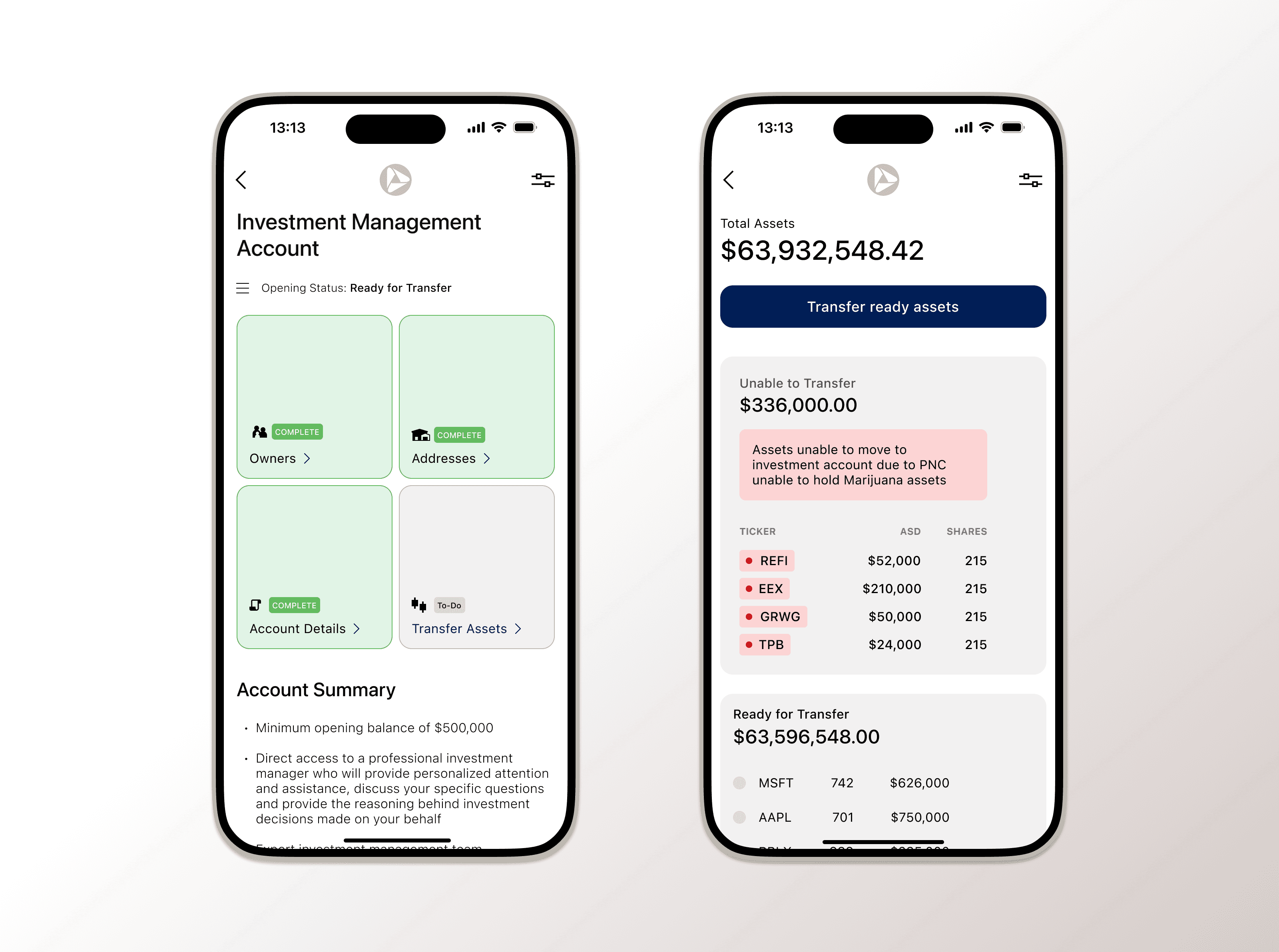

Transparencies in Transfers

But in the end, I delivered a product that allowed more transparency for users by setting expectations and educations. The product allowed clients have insight and control of portfolio transfers. For example, some national banks won't hold Marijuana stocks or assets… Like, Who knows that? not a lot of people but providing that information at the very beginning of an asset transfer allows for a better conversation and users can plan according.

PNC Private Bank

Timeline

2019 - 2021

My Role

Senior Product Designer

Time and Transfers

PNC Private Bank is a branch of aging high net-worth customers that have millions of invested assets. These clients are more concerned about how their money will assist their family in future. PNC wanted to prepare for a great movement of money to a younger generation and improve their digital products.

We started with the most obvious question. How do new and existing users move money? AND boy…. its rough.

Print to Pixels

PNC hasn't touched their Assets Management Account opening process since the Blackberry was #1 . Everything has always been done on paper/in-person, taking months to transfer assets . We wanted to update the process to something users have direct access to and track statuses.

Make it smarter and not an Advisor secret

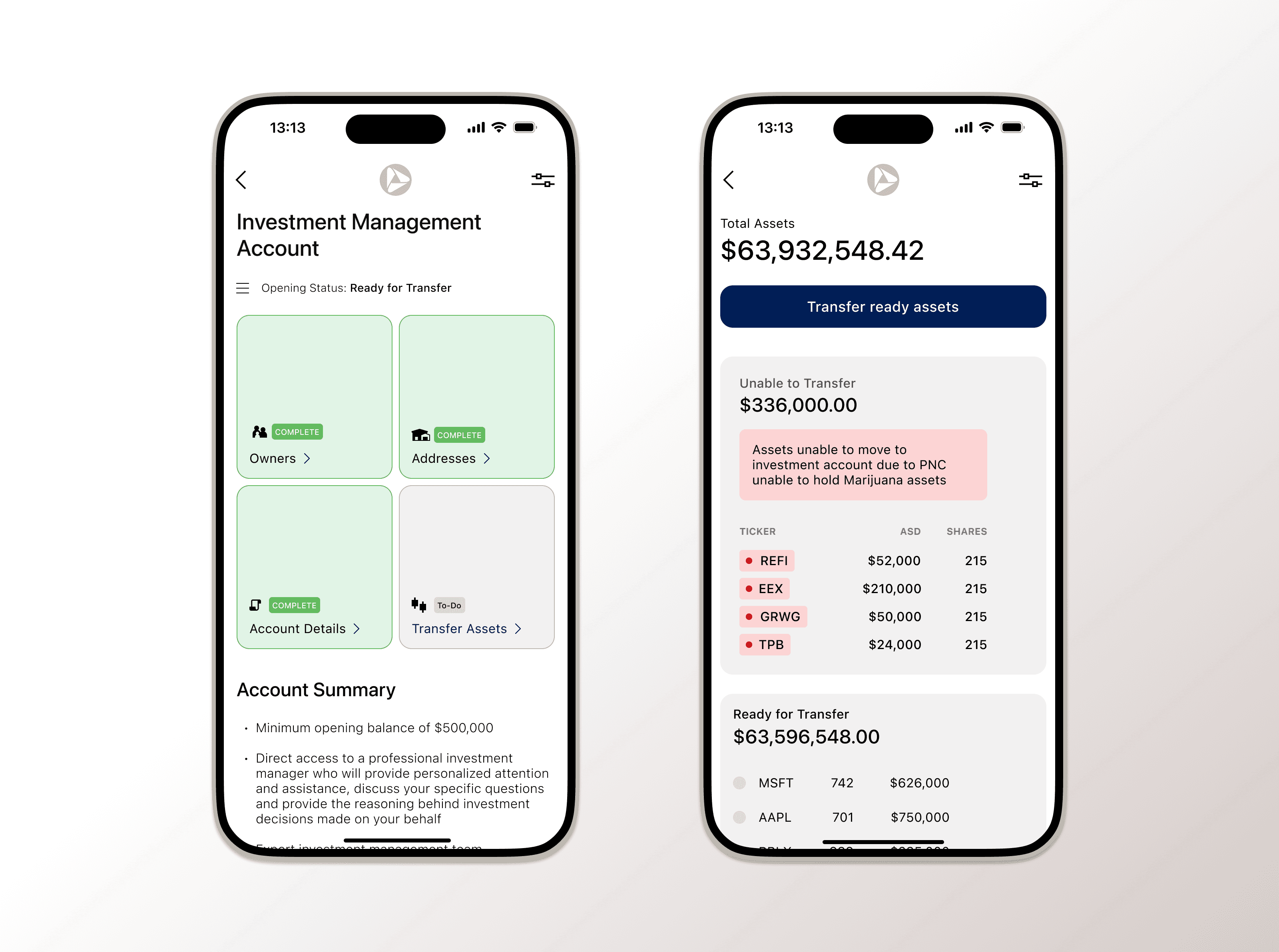

We created a process to make this process smarter rather than a subjective decision. Our new experience for setting up accounts would recommend account types based on users needs and portfolio sizes. Not only that, They could get the account started without having to meet up with an advisor at the local their Starbucks where someone has returned their latte twice and loudly complaining, all while you're trying to explain your families life goals to a stranger.

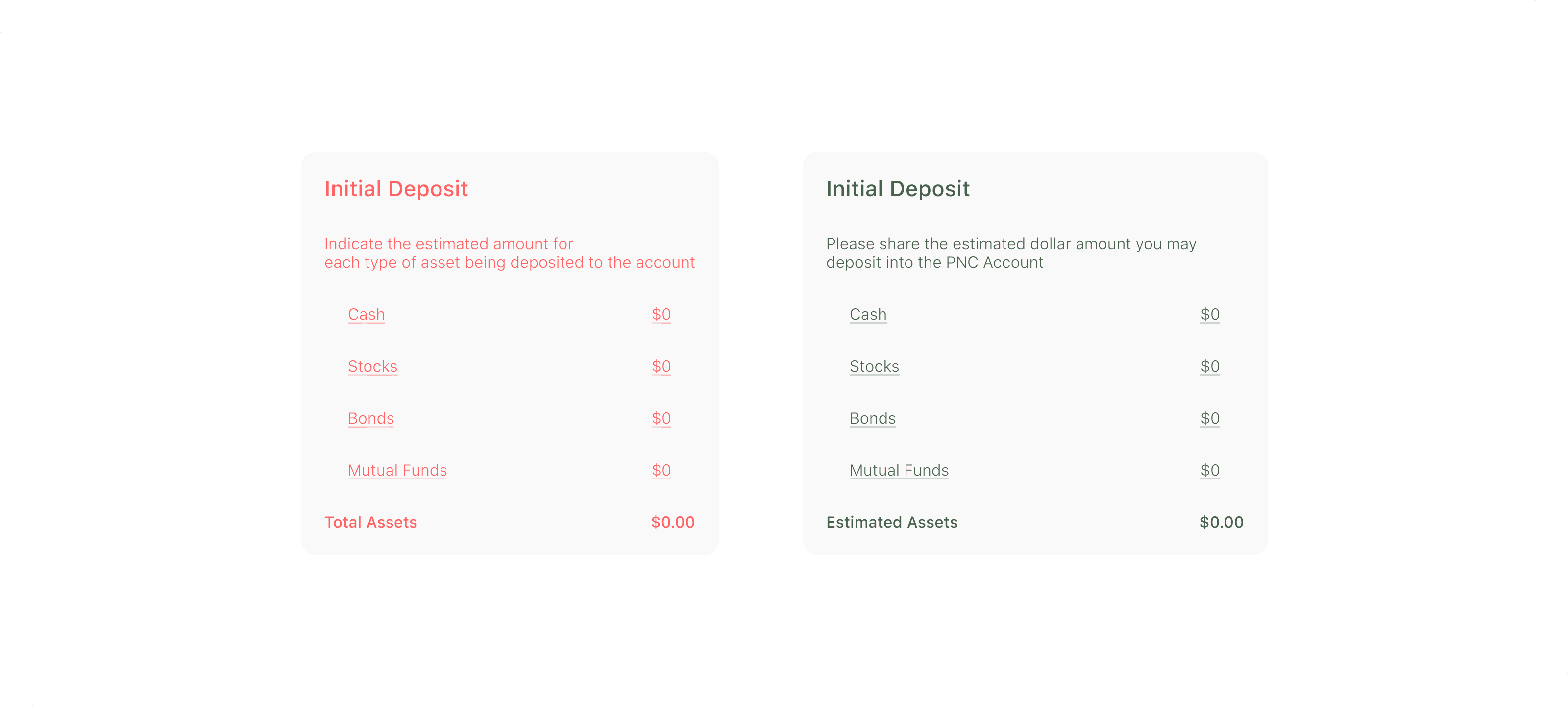

Making it sound less 'suit and tie'

In taking an old process and making it crisp for new users, we had to change a lot of the conversations. We Modified the lingo to either educate or better explaining how answer will effect their account.

Transparencies in Transfers

But in the end, I delivered a product that allowed more transparency for users by setting expectations and educations. The product allowed clients have insight and control of portfolio transfers. For example, some national banks won't hold Marijuana stocks or assets… Like, Who knows that? not a lot of people but providing that information at the very beginning of an asset transfer allows for a better conversation and users can plan according.

PNC Private Bank

Timeline

2019 - 2021

My Role

Senior Product Designer

Time and Transfers

PNC Private Bank is a branch of aging high net-worth customers that have millions of invested assets. These clients are more concerned about how their money will assist their family in future. PNC wanted to prepare for a great movement of money to a younger generation and improve their digital products.

We started with the most obvious question. How do new and existing users move money? AND boy…. its rough.

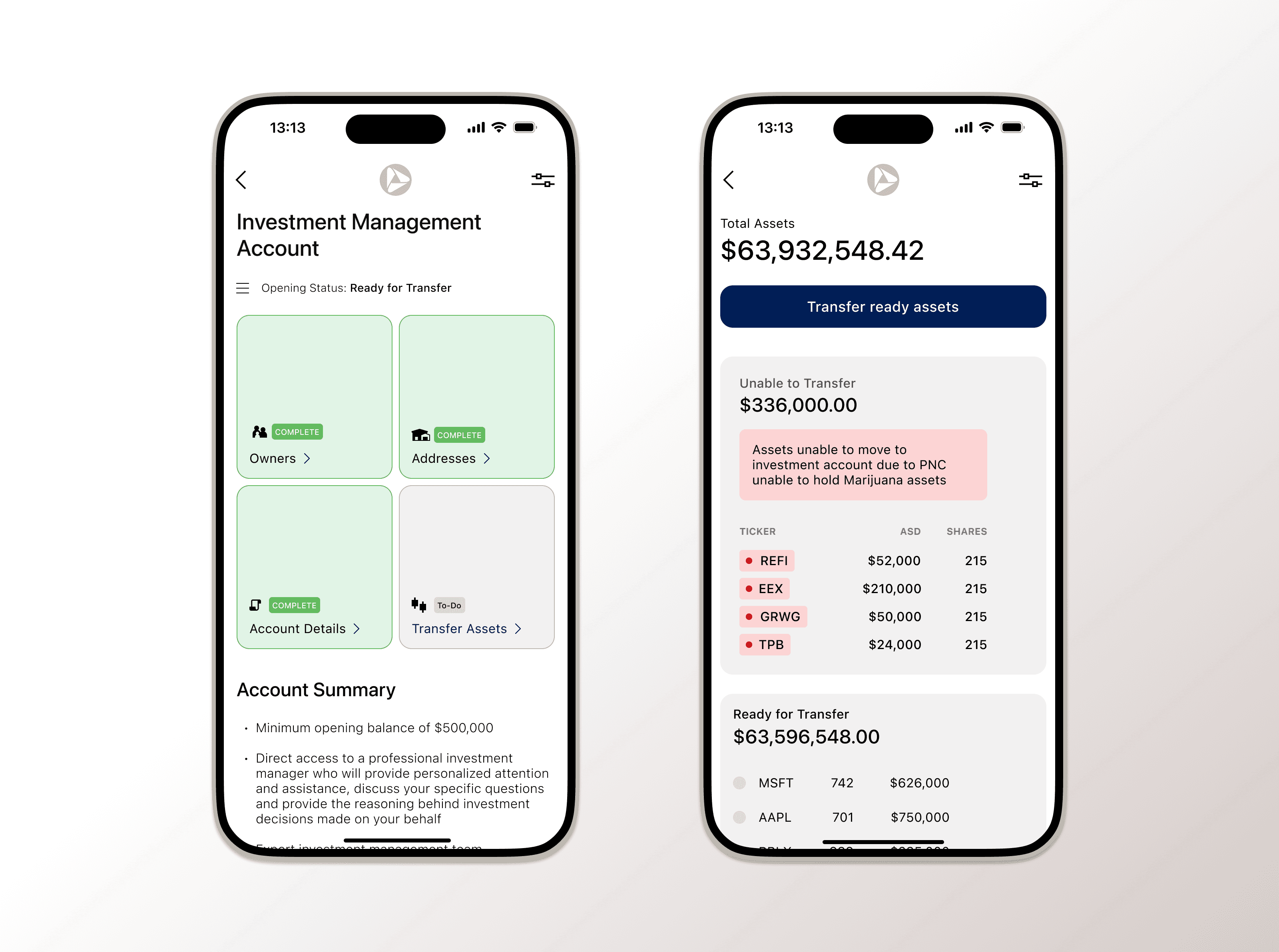

Print to Pixels

PNC hasn't touched their Assets Management Account opening process since the Blackberry was #1 . Everything has always been done on paper/in-person, taking months to transfer assets . We wanted to update the process to something users have direct access to and track statuses.

Make it smarter and not an Advisor secret

We created a process to make this process smarter rather than a subjective decision. Our new experience for setting up accounts would recommend account types based on users needs and portfolio sizes. Not only that, They could get the account started without having to meet up with an advisor at the local their Starbucks where someone has returned their latte twice and loudly complaining, all while you're trying to explain your families life goals to a stranger.

Making it sound less 'suit and tie'

In taking an old process and making it crisp for new users, we had to change a lot of the conversations. We Modified the lingo to either educate or better explaining how answer will effect their account.

Transparencies in Transfers

But in the end, I delivered a product that allowed more transparency for users by setting expectations and educations. The product allowed clients have insight and control of portfolio transfers. For example, some national banks won't hold Marijuana stocks or assets… Like, Who knows that? not a lot of people but providing that information at the very beginning of an asset transfer allows for a better conversation and users can plan according.